California holds momentum with 100K+ new EVs sold, while nationwide used EV sales also top 100K

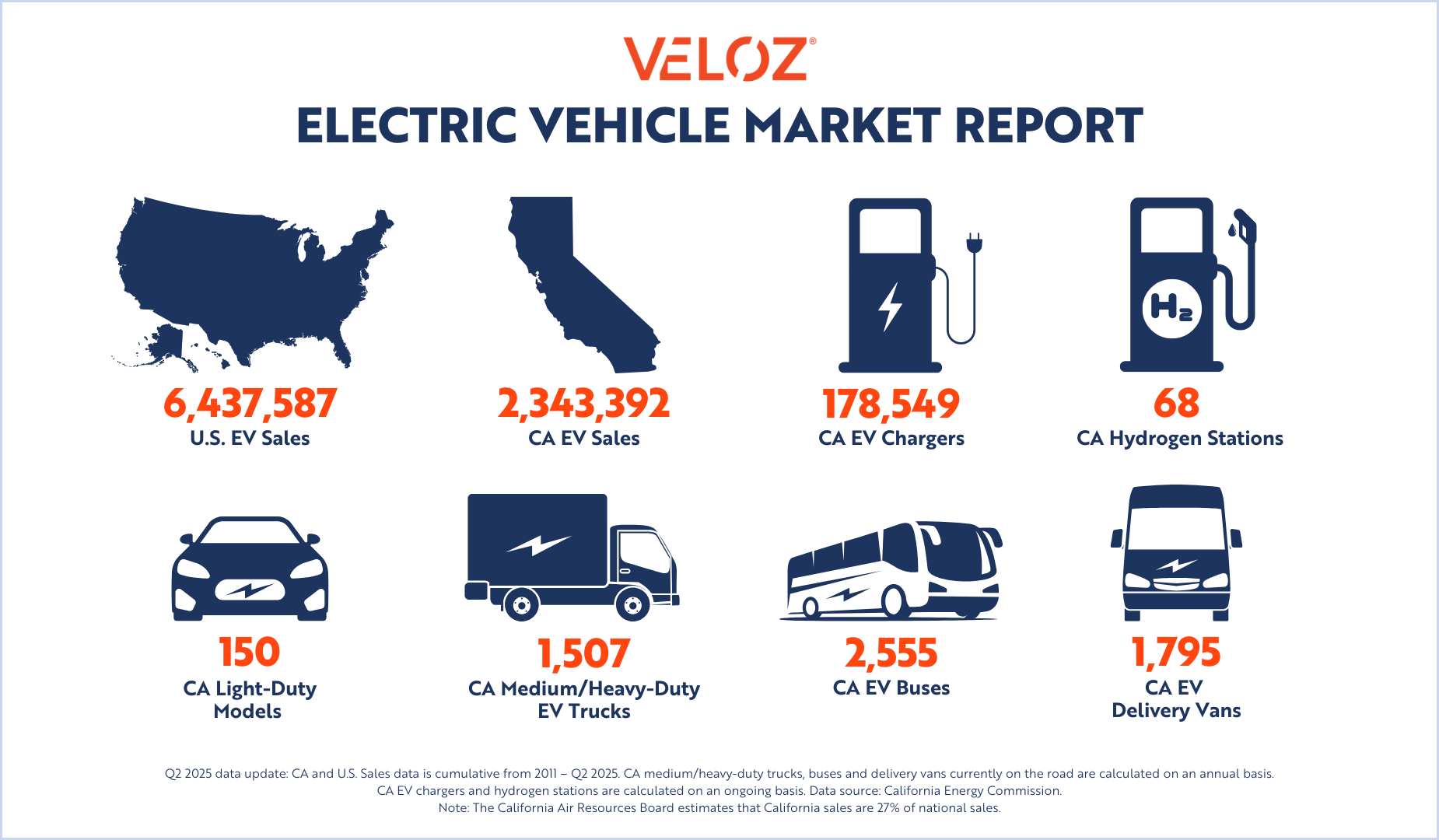

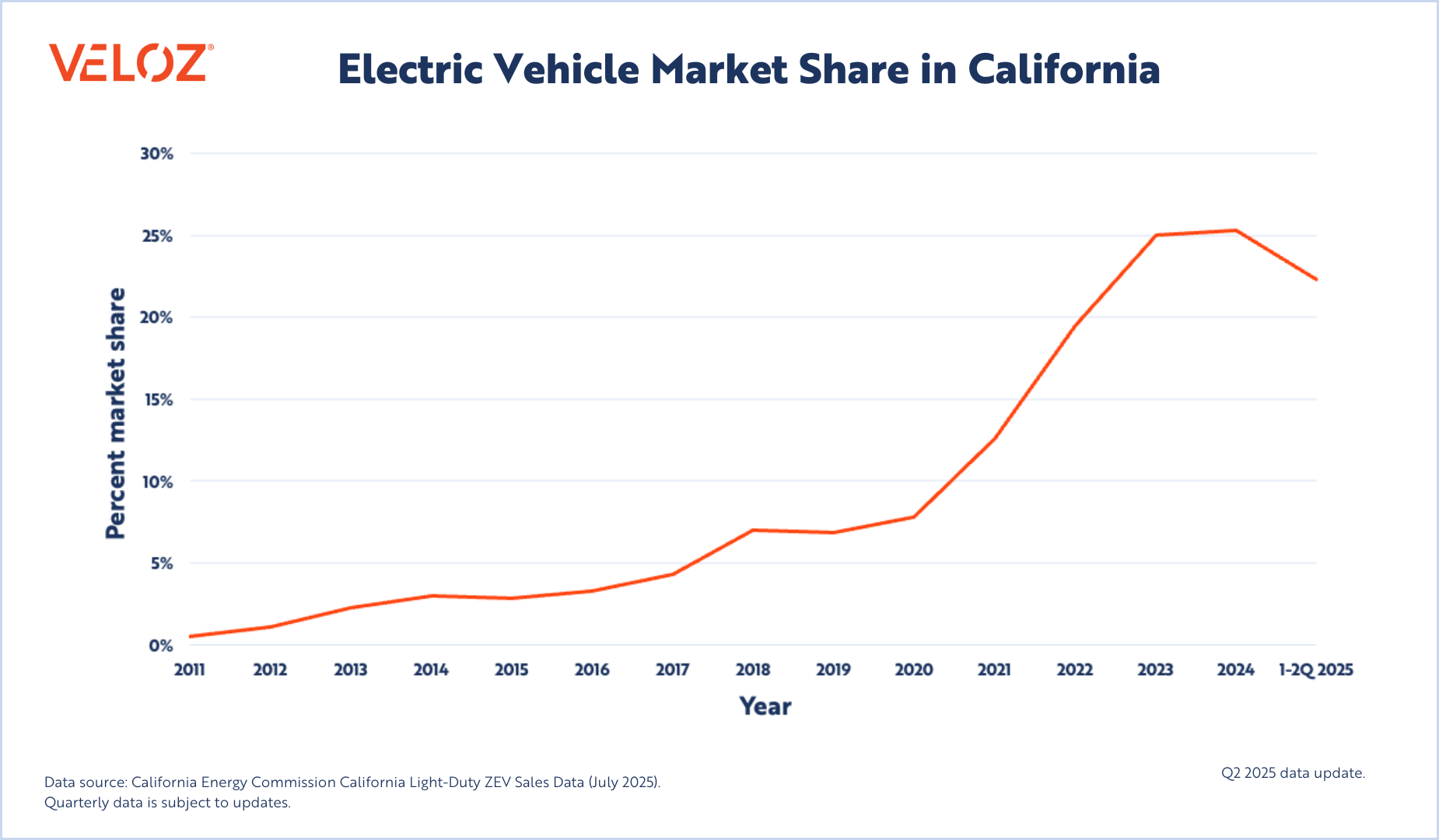

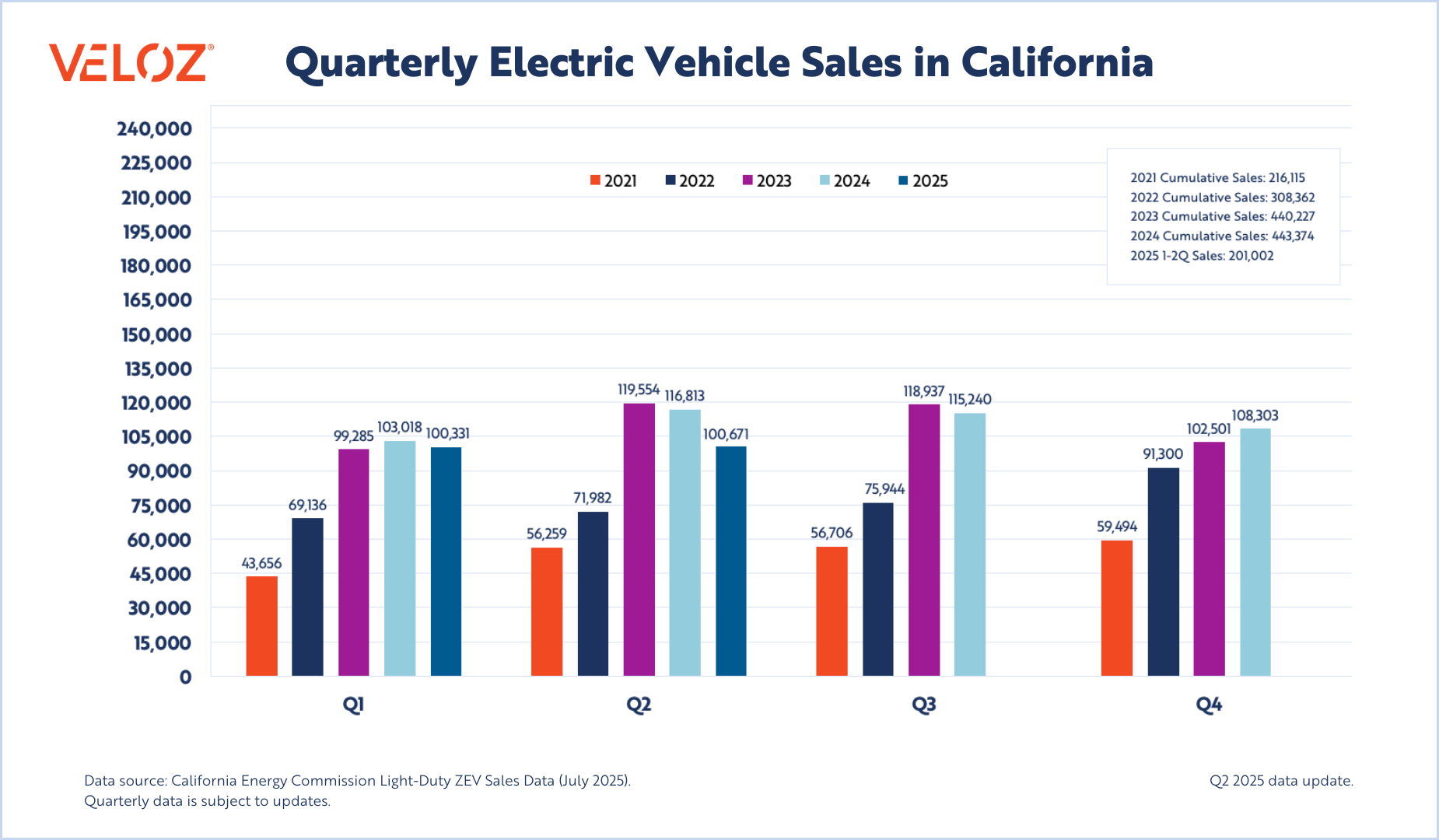

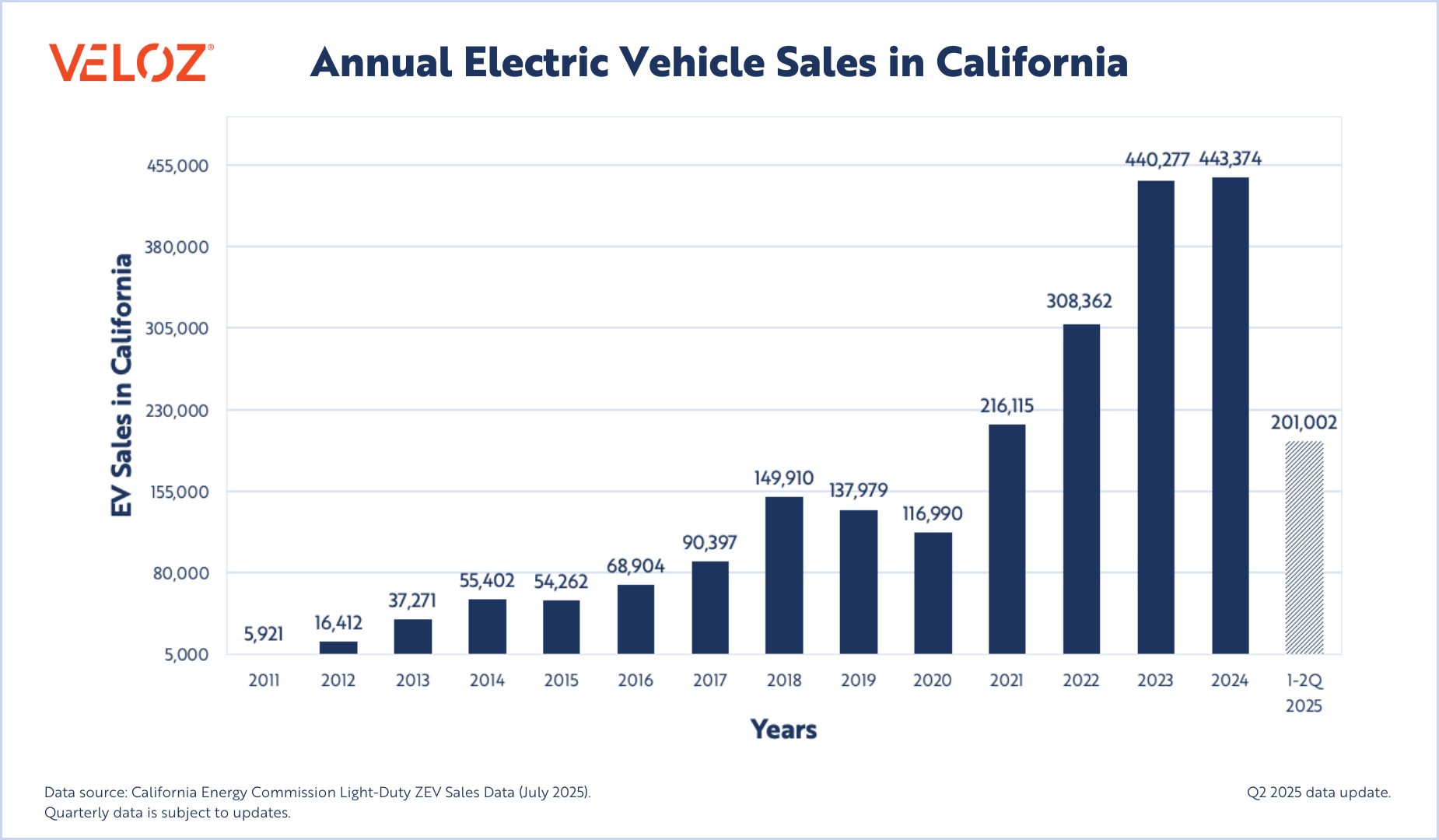

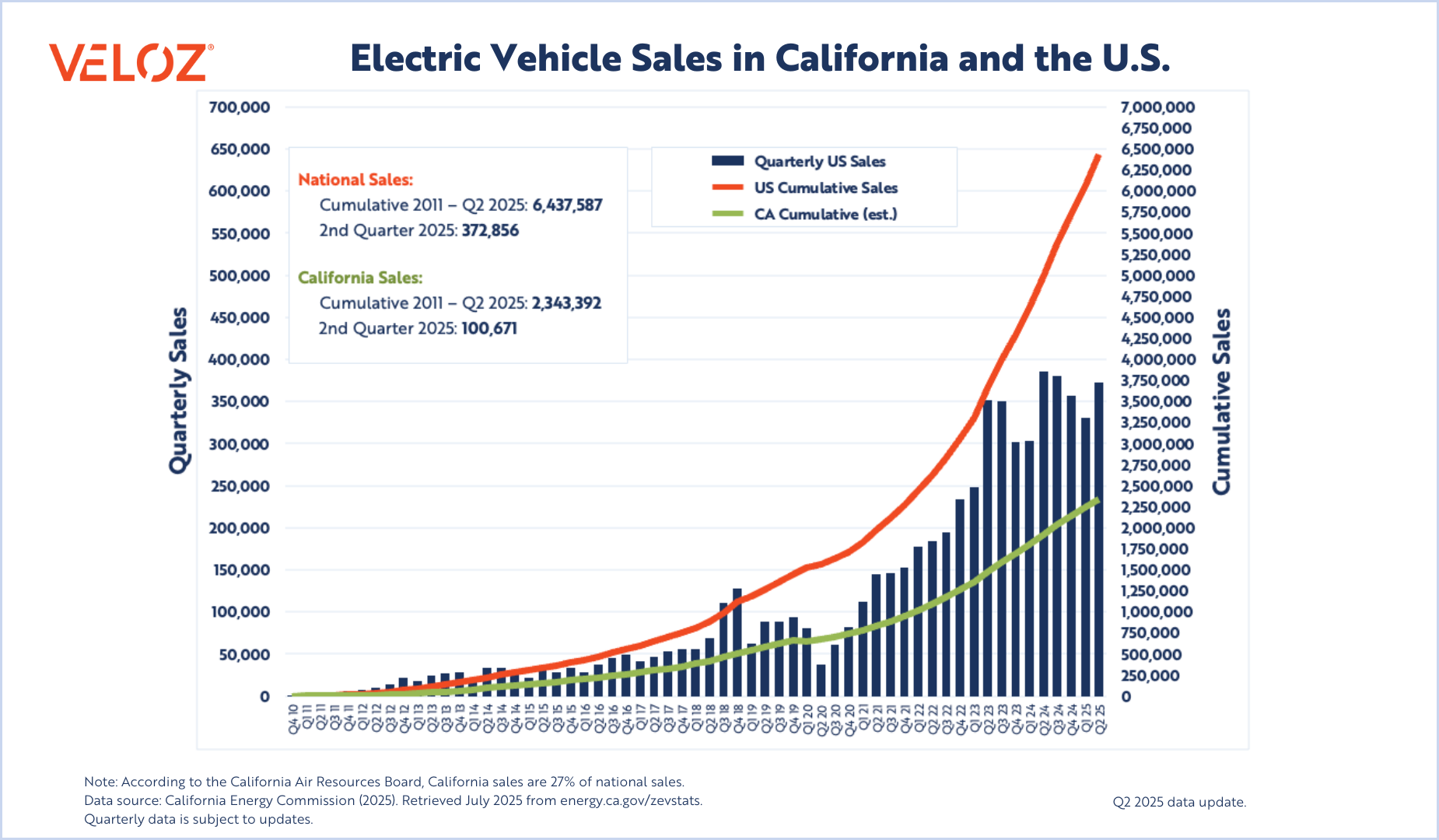

California added 100,671 new electric vehicles in Q2 2025, claiming 21.6% of the state’s light-duty vehicle market. That’s a modest dip from 23% in the prior quarter, yet it marks twelve straight quarters with EV share holding above 20 percent — evidence of a maturing market. Nationally, 310,839 new EVs were sold in Q2 2025, representing a 4.9% increase over Q1, with total new EV sales for the first half of the year reaching a record 607,089, up 1.5% year-over-year. Used EV retail sales in the U.S. also passed a threshold long-anticipated by analysts, surpassing 100,000 units for the first time. Taken together, these numbers suggest a market that has moved beyond the proving ground stage and into a stage where the mainstream consumer is taking the wheel.

Statewide total light-duty vehicle sales climbed about 3% year-over-year in Q2 2025, the strongest single-quarter showing since Q2 2023, as buyers accelerated purchases ahead of anticipated tariffs. That short-term surge in internal combustion sales pulled EV market share down slightly, yet EV demand held steady with more than 100,000 new registrations for the ninth consecutive quarter. Consumers also had more to choose from than ever before, with 150 EV models available this quarter — up 36% from a year ago — a factor reshaping which vehicles make it to the top 10 list.

California’s top ten EVs in Q2 2025 reflect a healthy mix of returning favorites and rising challengers. Notably, Acura’s national Q2 sales rose approximately 11.8% year-over-year, with the ZDX breaking into the top 10 models sold in California for the first time. The Hyundai Ioniq 5 also stood out, ranking third among all EVs sold in the state in Q2. These shifts indicate growing consumer interest in choice and significant brand-switching behavior within the segment. New EV models come out every quarter, and California remains a key market and launchpad for EV progress across the country. Strong showings from Hyundai, GM, Nissan, BMW, Stellantis, Rivian, Acura, and Ford signal a maturing market where consumers have more choice and new EV models can compete and win.

Top ten EVs in California, Q2 2025:

- Tesla Model Y

- Tesla Model 3

- Hyundai Ioniq 5

- Chevrolet Equinox EV

- Nissan Ariya

- BMW i4

- Jeep Wrangler 4xe

- Rivian R1S

- Acura ZDX

- Ford Mustang Mach-E

Q2 2025 marked a long-anticipated milestone for the EV industry: used EV retail sales surpassed 100,000 units nationwide for the first time, representing a 27% gain over Q1 and a 45% increase year-over-year. Tesla trade-ins — up from 1.3% to 4.5% of total trade-ins in the state over the past year — helped unlock this growth, as first-generation EV owners cycled out of their vehicles, allowing a broader range of drivers to gain access to pre-owned EVs. According to Fast Company, Teslas are among the fastest-selling used EVs nationally, underscoring how California’s rising trade-in activity is fueling broader access to pre-owned EVs across the country.

California’s trade-in activity is a major contributor, but it’s not the only factor fueling record used EV sales. Federal policy shifts and improved battery performance are adding momentum to this growing market. Analysts point to the Inflation Reduction Act’s leasing loophole, which allowed leased EVs to qualify for the $7,500 commercial credit, as a key driver, spurring a surge of leases in 2023–2025 that are now rolling off and supplying the used‑EV market. Another factor boosting consumer trust and interest in used EVs is improving battery longevity: recent data shows modern EV batteries degrade at only about 1.8% per year, often retaining more than 80% of their original capacity after a decade, strengthening long-term value and resale confidence. According to Geotab’s 2025 analysis of over 10,000 EVs, today’s batteries are built to last 20 years or more, often outliving the vehicles they power. As owners of earlier EV models transition to newer options, nearly new models are entering the market at lower price points, making EV ownership more attainable for a broader range of drivers.

National data shows the EV shift is both economic and demographic. A growing body of research confirms that used EVs are being adopted by drivers across various income, housing, and education profiles. EV drivers can save over $2,000 on gas alone, which adds up to about $166 saved each month. Expanding access to the used EV market is one of the most effective ways to deliver these financial benefits more broadly.

According to the California Air Resources Board (CARB), 27% of new EVs sold in the U.S. are sold in California. Nationally, several automakers posted notable gains in Q2 2025. General Motors delivered 46,280 EVs, more than doubling its Q2 2024 total and achieving a 111% year-over-year increase. By end of Q2 2025, GM had sold over 78,000 EVs, capturing 13% of the national market and securing its position as the second-largest EV manufacturer after Tesla. Cadillac continued its momentum in the luxury segment, with 25% of Lyriq buyers coming from Tesla and Optiq conquest rates nearing 80%.

Charging Infrastructure Growth

California’s charging network has surged ahead, now has roughly 50% more EV charging ports than gasoline nozzles according to the CEC. In Q2 2025, the U.S. continued expanding its fast-charging network at a record pace, adding 4,242 new DC fast charging ports, a 23% increase over Q1, bringing the national total to nearly 59,700 ports across 784 stations. Notably, the buildout is trending toward higher-capacity equipment, with 63% of new ports capable of delivering 250 kW or more, up from 47% in the prior quarter. This shift toward larger, faster stations is expected to reduce wait times, improve charging reliability, and support broader EV adoption as more high-powered options become available nationwide. Electrify America alone reported over 16 million DC fast‑charging sessions in 2024, a 50% jump from the previous year, underscoring how quickly public charging is becoming a standard part of everyday driving.

Federal Incentives and State-Level Support

Federal tax incentives and leasing benefits helped more drivers make the switch. These federal programs are set to sunset after September 30, 2025, but state-level policy activity remained strong in Q2 2025, with 36 states and Puerto Rico advancing actions to support EV adoption and charging infrastructure. These state measures included new rebate programs, managed charging initiatives, rate design updates, and long-term infrastructure planning.

Across the country, states are setting a faster pace for EV infrastructure growth. Georgia now ranks sixth in the nation for public charging stations and leads the Southeast in more outlets per capita, setting a regional benchmark. Colorado Energy Office awarded $21 million in grants to fund around 290 new fast-charger ports across 46 sites, bolstering EV support in rural and urban areas alike. And in the Northeast, Massachusetts capped Q2 2025 as the most EV-friendly state in the nation overall, pairing top-five charging access with competitive rebates to accelerate adoption.

Elsewhere, Arkansas surpassed 60,000 registered EVs by mid-year, a 24% increase over 2024, with quarterly registrations climbing 35.5% year-over-year. Washington boosted affordability through an expanded sales and use tax exemption, allowing buyers to save up to $15,000 on new EVs and $16,000 on used models, even for private and leased purchases statewide.

These state-level wins are not isolated. They signal a broader shift in how the U.S. market is embracing EVs, building the foundation for long-term national adoption. The lesson from Q2 is clear: consumers are steadily choosing EVs in California and across the nation, and even modest growth in some markets is reinforcing electric mobility as a lasting part of the automotive landscape. Alongside policy changes at the state level, consumer EV education continues to close the knowledge gap with programs like Electric For All. Educating everyday Americans about the benefits EVs is a policy lever and a market accelerator that needs investment. As states bring forth new EV policies to empower consumers, charging providers continue improving reliability and increasing the availability of fast charging, and the industry invests in consumer education, the demand for EVs will continue.

For media inquiries, please contact Margaret Mohr, Veloz Communications Director, at margaret.mohr@veloz.org.