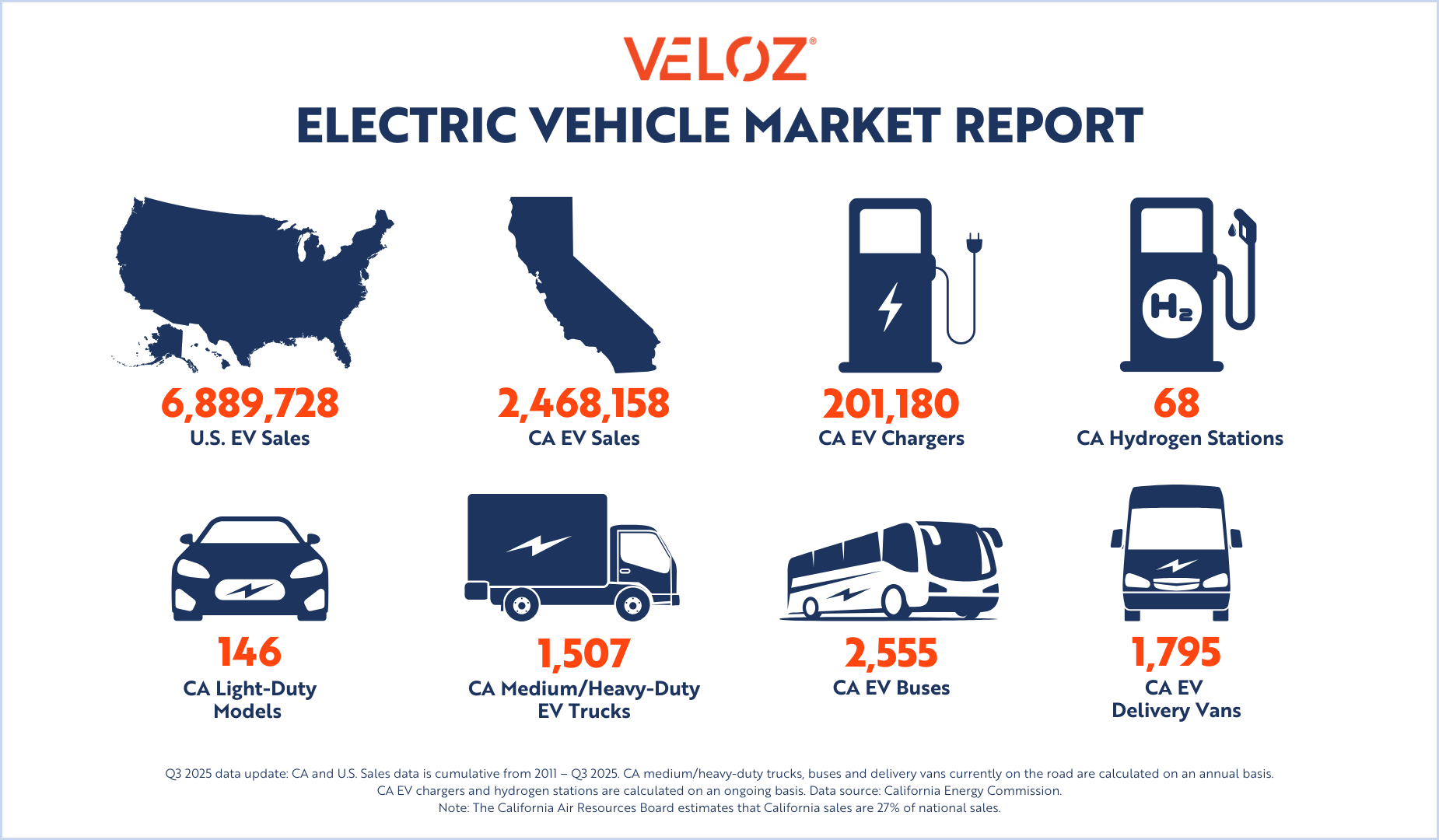

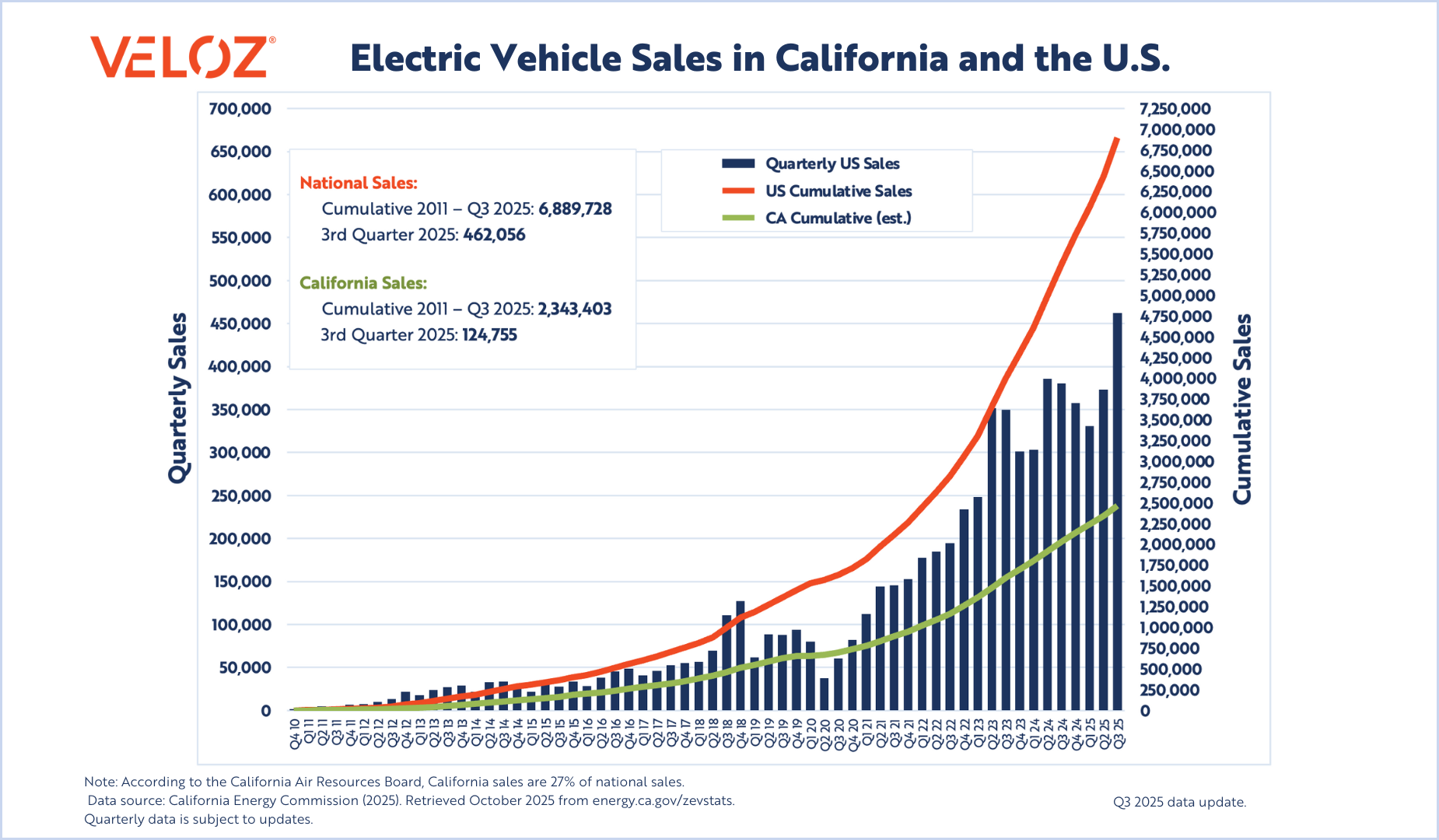

New EV sales increase 8.3% year over year in Q3, and over 201,000 EV Chargers are now available across the state as infrastructure and adoption accelerate

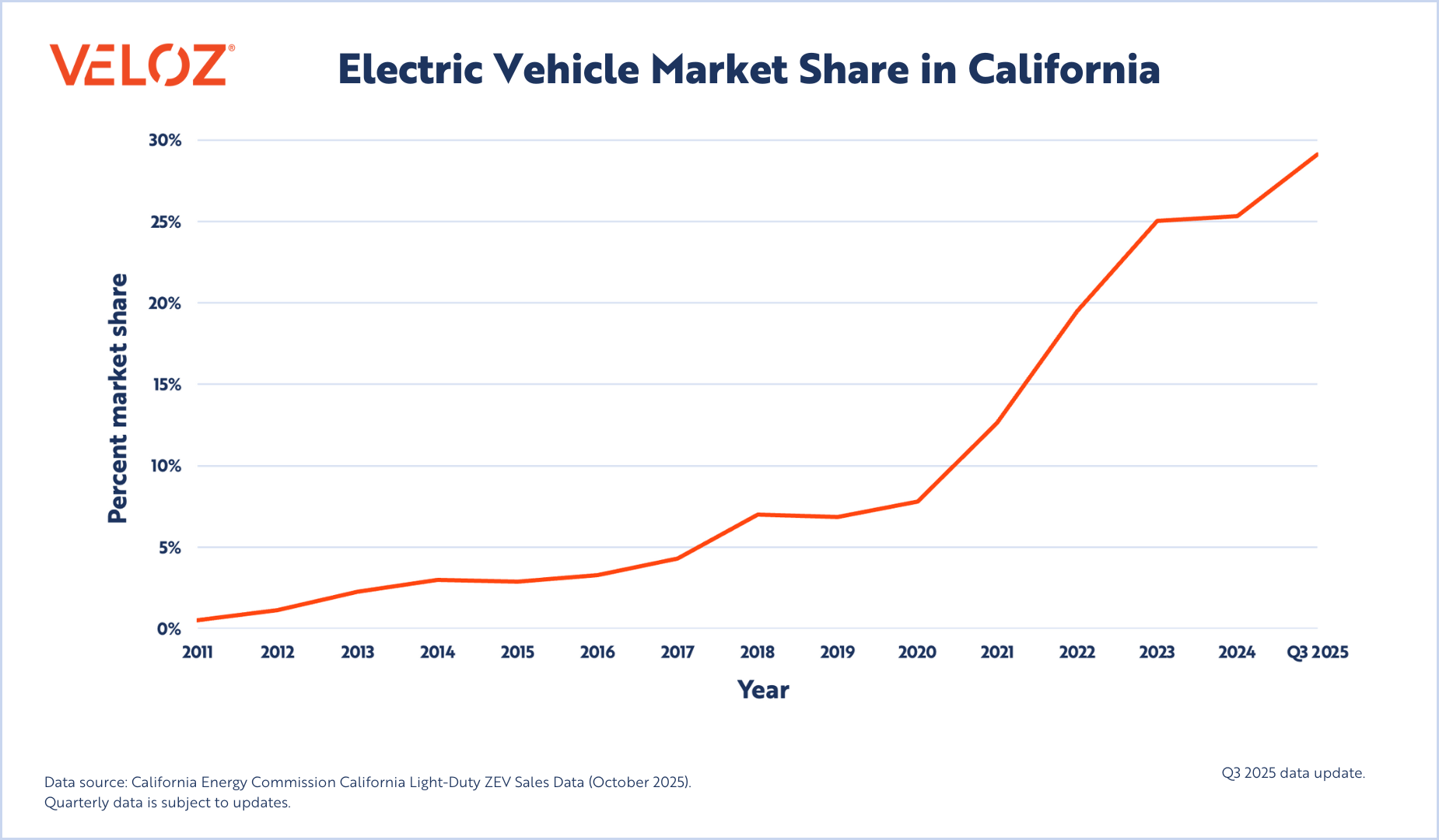

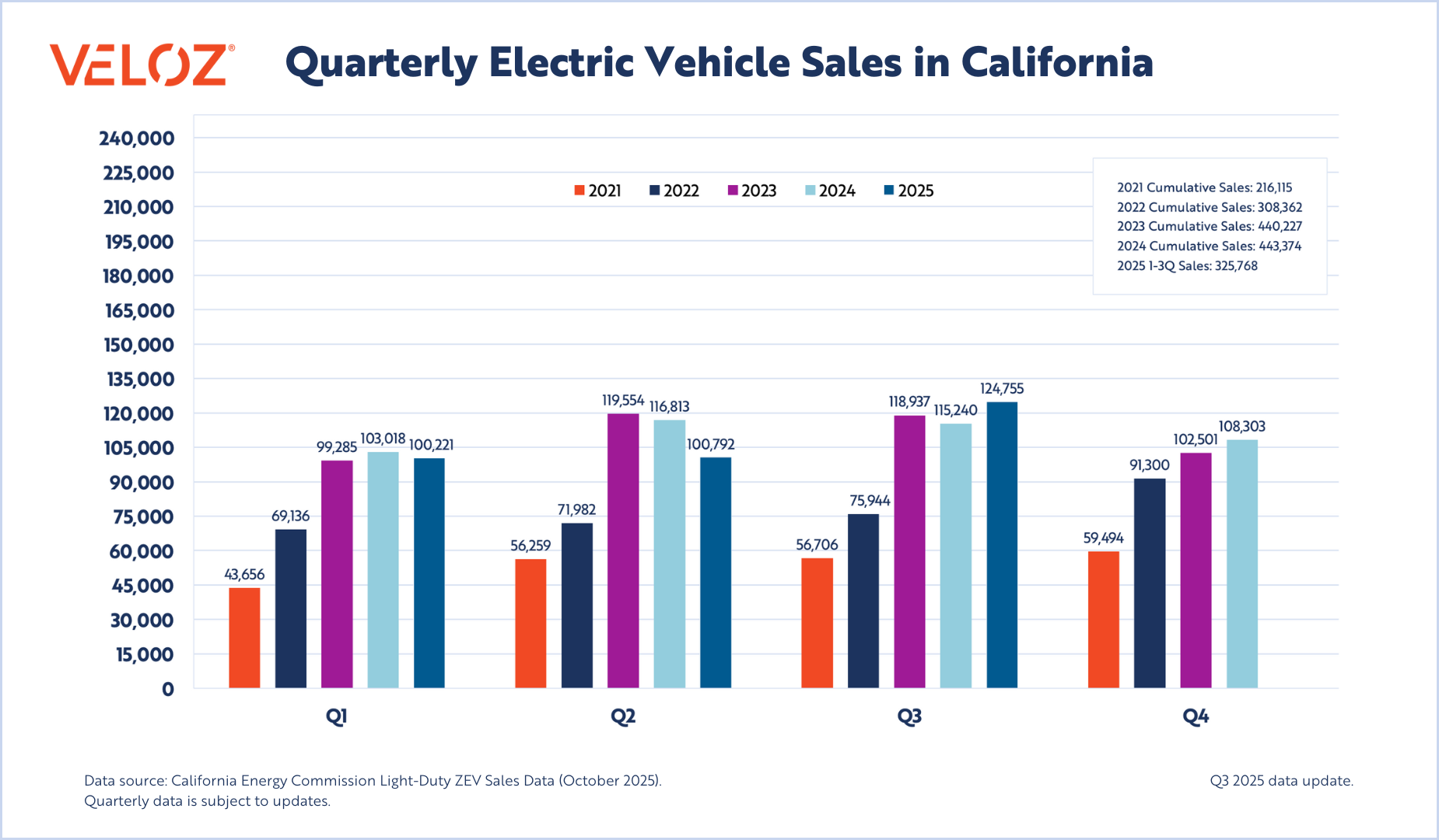

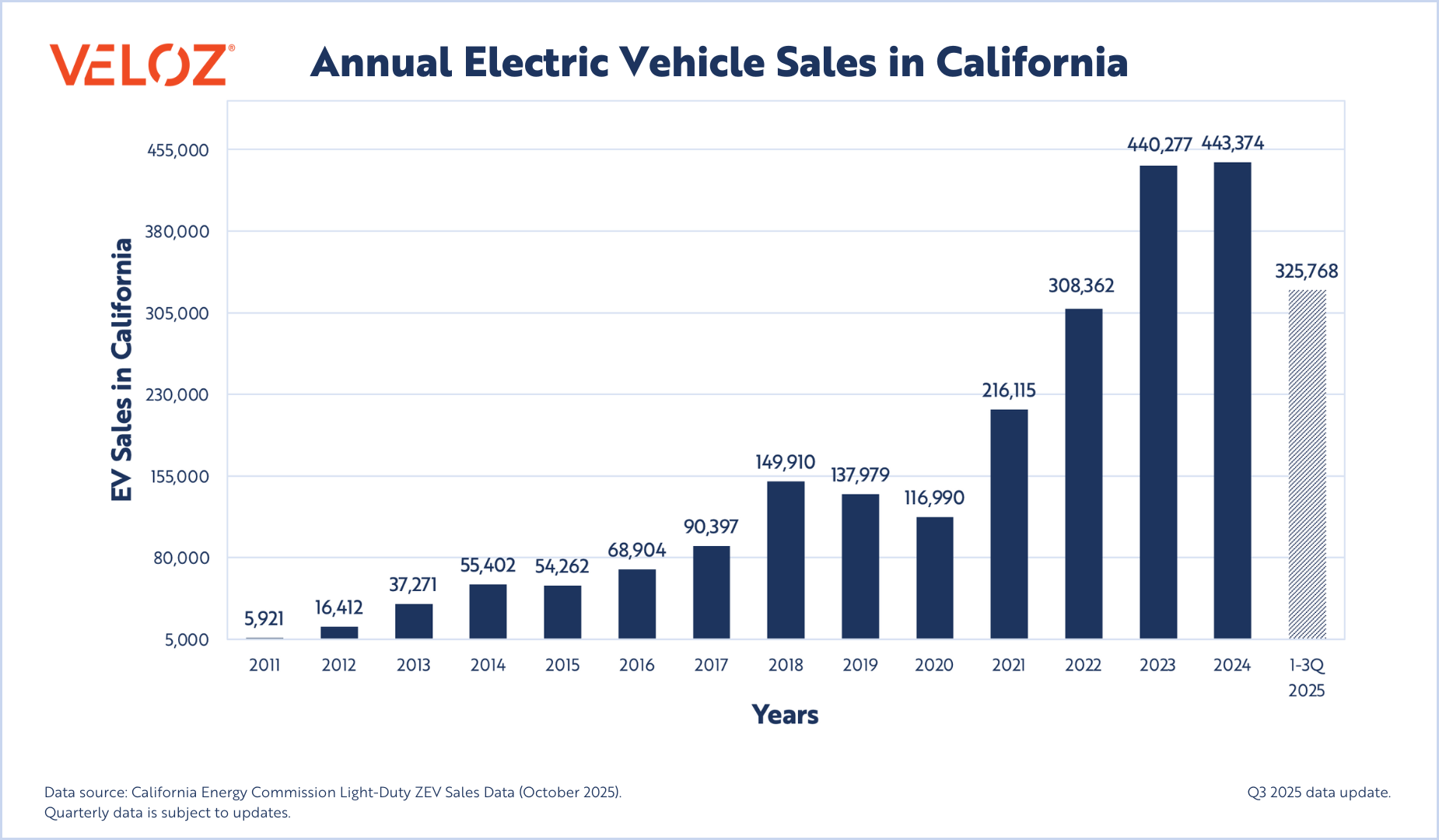

California added 124,755 new electric vehicles in Q3 2025, claiming a record 29.1% of the state’s light-duty vehicle market. Coming in as the highest quarterly market share to date, the market share is a notable climb from 21.7% in the prior quarter and represents an 8.3% year-over-year increase from 115,240 new ZEVs in Q3 2024. It also marks five consecutive years with EV share holding above 20 percent. At the same time, used EV sales remained above the 100,000-unit mark, continuing a steady secondary-market climb. With more than 200,000 public chargers now online statewide and first-in-the-nation reliability standards in effect, California’s EV charging infrastructure has entered a phase of parity with gas pumps while EV adoption gains momentum nationwide.

California’s EV sales momentum in Q3 2025 comes at a time when gas car sales slipped both quarter-over-quarter (down 16.5%) and year-over-year (down 5.83%). Across the U.S., major automakers and EV makers are hitting new milestones: Tesla delivered a record 497,099 vehicles globally in Q3, bolstered in part by the timing of the federal tax credits sunsetting. Meanwhile, Polestar reported a 13% year-over-year jump in quarterly EV sales and GM’s recent move to relaunch a sub-$30,000 Bolt EV signals a priority in providing choices among mass market EVs. The numbers appear to tell a simple story: the auto industry’s future growth now runs on electric power.

The shift was most visible at the model level, where a familiar mix of leaders and new contenders drove California’s record market share.

Tesla once again led the state’s rankings with the Model Y and Model 3, which together accounted for more than 46,000 new registrations this quarter. The Hyundai Ioniq 5 held third place, followed by the Honda Prologue, which again secured a top-ten ranking consistent with its earlier strong performance in the market.

Three Veloz members—Ford, GM, and Audi—also delivered standout performances. Ford’s Mustang Mach-E ranked fifth statewide, maintaining its momentum among midsize crossovers and contributing to Ford’s 30% year-over-year national EV growth, driven by record F-150 Lightning deliveries. General Motors’ Chevrolet Equinox EV came in in sixth, reinforcing its presence in the compact SUV market following GM’s strongest EV quarter on record: 66,501 EVs delivered nationwide. Audi’s Q6 e-tron was eighth on the list, reflecting a successful California launch for the brand’s next-generation electric platform.

Rounding out the top ten were the Volkswagen ID.4, Rivian R1S, and Mercedes-Benz GLC PHEV, demonstrating continued strength from both established and emerging automakers. California’s EV market has matured into what every automaker now chases: growth powered by variety and sustained by demand.

Top ten EVs in California, Q3 2025:

- Tesla Model Y

- Tesla Model 3

- Hyundai Ioniq 5

- Honda Prologue

- Ford Mustang Mach-E

- Chevrolet Equinox EV

- Volkswagen ID.4

- Audi Q6 e-tron

- Rivian R1S

- Mercedes-Benz GLC PHEV

California continued to strengthen the electric future by supporting its EV infrastructure growth in Q3 2025, advancing both the scale and reliability of its charging network. In September, the California Energy Commission (CEC) announced that the state had surpassed 200,000 public and shared EV charging ports, a milestone that underscores California’s leadership in national infrastructure deployment.

The following month, the CEC adopted the nation’s first reliability and reporting standards for EV chargers, requiring consistent uptime performance and transparent data sharing for publicly funded stations. These regulations will help ensure that chargers are not only widespread but dependable—critical for public confidence as EV adoption accelerates.

At the same October meeting, commissioners also approved more than $10 million in new grants to repair non-operational stations and add over 1,000 Level 2 charging ports, most of them in affordable or multi-unit housing complexes. In parallel, the state launched the $55 million Fast Charge California Project, which provides funding to cover up to 100% of installation costs for new DC fast chargers along key travel corridors.

States now hold the power, and responsibility, to lead the clean-mobility transition through their own policies, incentives, and infrastructure commitments.

Across the country, Q3 2025 saw continued acceleration in electric vehicle adoption, driven in part by rising consumer engagement and awareness as federal incentives expired, alongside continued state and local incentives. Veloz’s own Electric For All consumer education campaign reached 425 million paid media impressions and nearly 1 million visits to its education platform in just its first two months, helping guide prospective buyers through incentives, charging options, and cost savings.

States are increasingly shaping the pace of EV adoption through their own programs and investments:

- Colorado currently offers a state tax credit of up to $3,500 for qualifying EV purchases (with additional bonus amounts for lower-priced vehicles). Separately, the Vehicle Exchange Colorado (VXC) rebate program provides income-qualified drivers (who replace older, high-emitting vehicles) with rebates of up to $6,000 for new EVs.

- Connecticut’s CHEAPR program: The Connecticut Hydrogen and Electric Automobile Purchase Rebate (CHEAPR) offers incentives to Connecticut residents who purchase or lease an eligible new or used battery electric (BEV) or, plug-in hybrid electric (PHEV) vehicle from a licensed Connecticut automobile dealership or original equipment manufacturer.

- Massachusetts’ MOR-EV initiative provide rebates for new and used EVs, with enhanced support for income-qualified buyers.

- New York’s Drive Clean Rebate offers up to $2,000 toward the purchase or lease of eligible models.

- New Jersey’s Charge Up program provides as much as $4,000 for new EVs plus charger incentives.

State-driven policies are sustaining consumer demand, broadening affordability, and building regional momentum even amid shifting federal frameworks.

Taken together, record sales, expanding infrastructure, and steady state leadership signal an EV market entering a new phase. Even amid federal policy rollbacks and shifting national priorities, state and regional action remain central to progress, helping ensure that adoption continues to rise and access continues to expand across the country.

For media inquiries, please contact Margaret Mohr, Veloz Communications Director, at margaret.mohr@veloz.org.