Overall EV Sales Growth Continues Across U.S. as Traditional Automakers Increase EV Sales

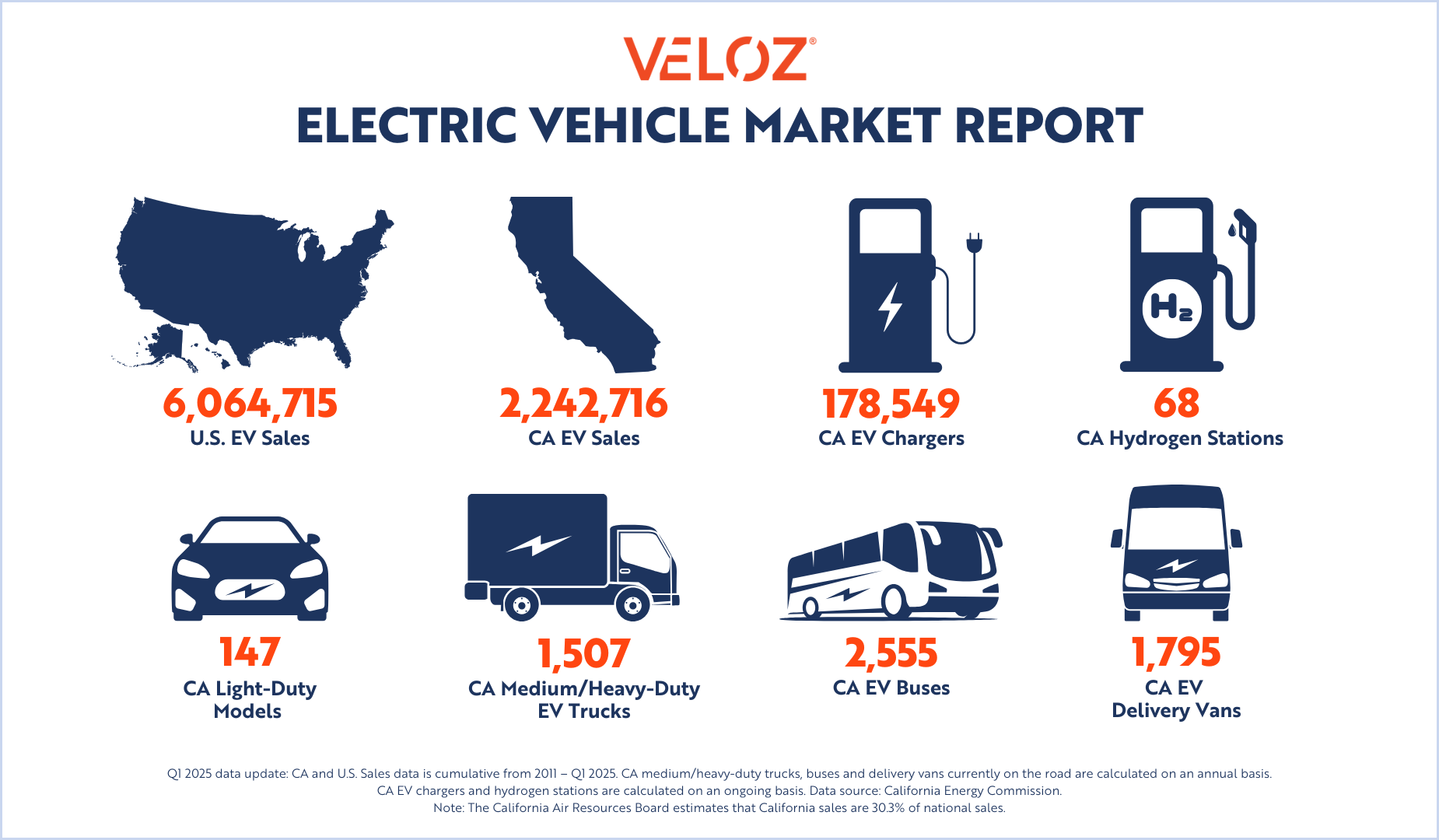

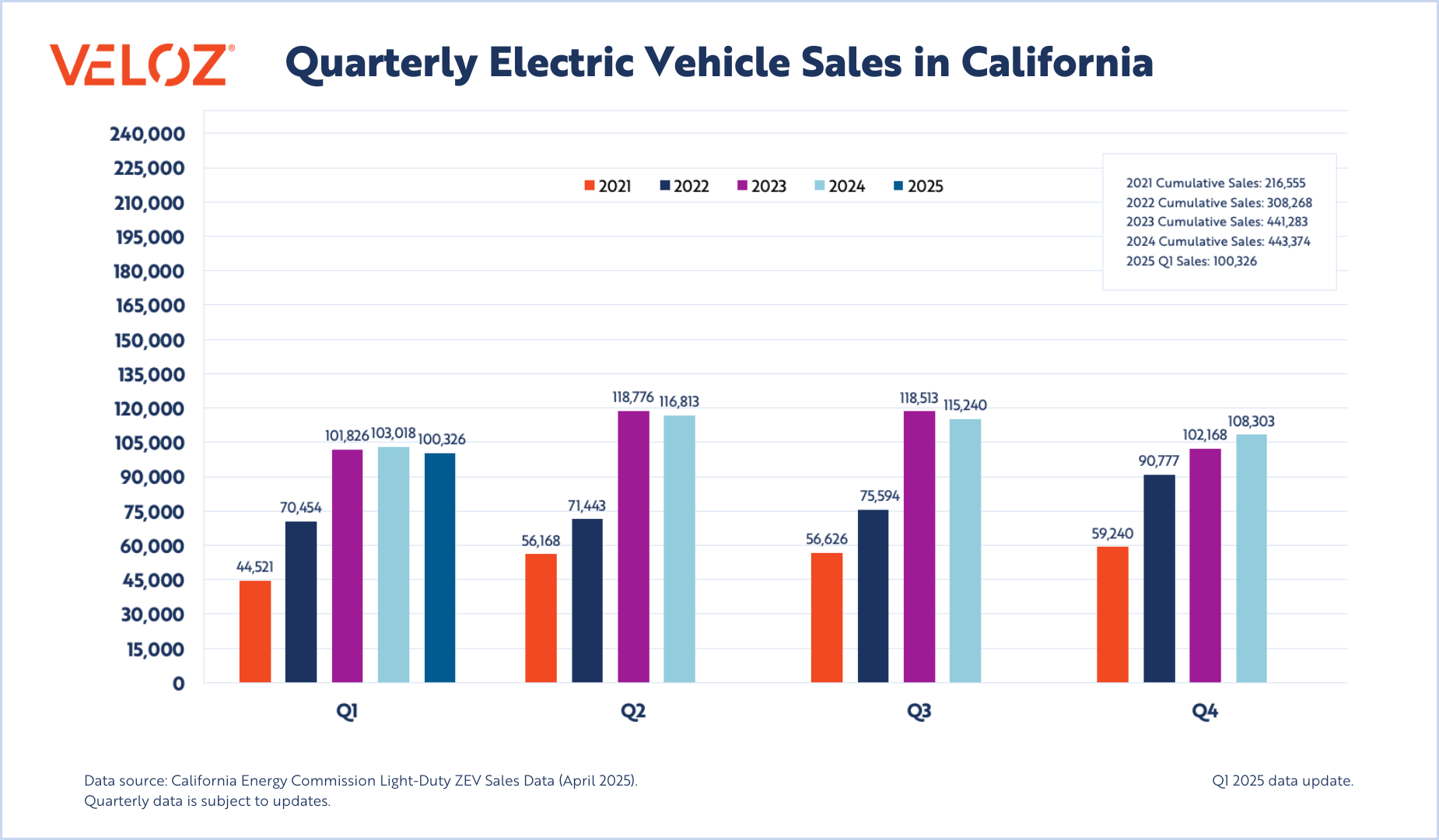

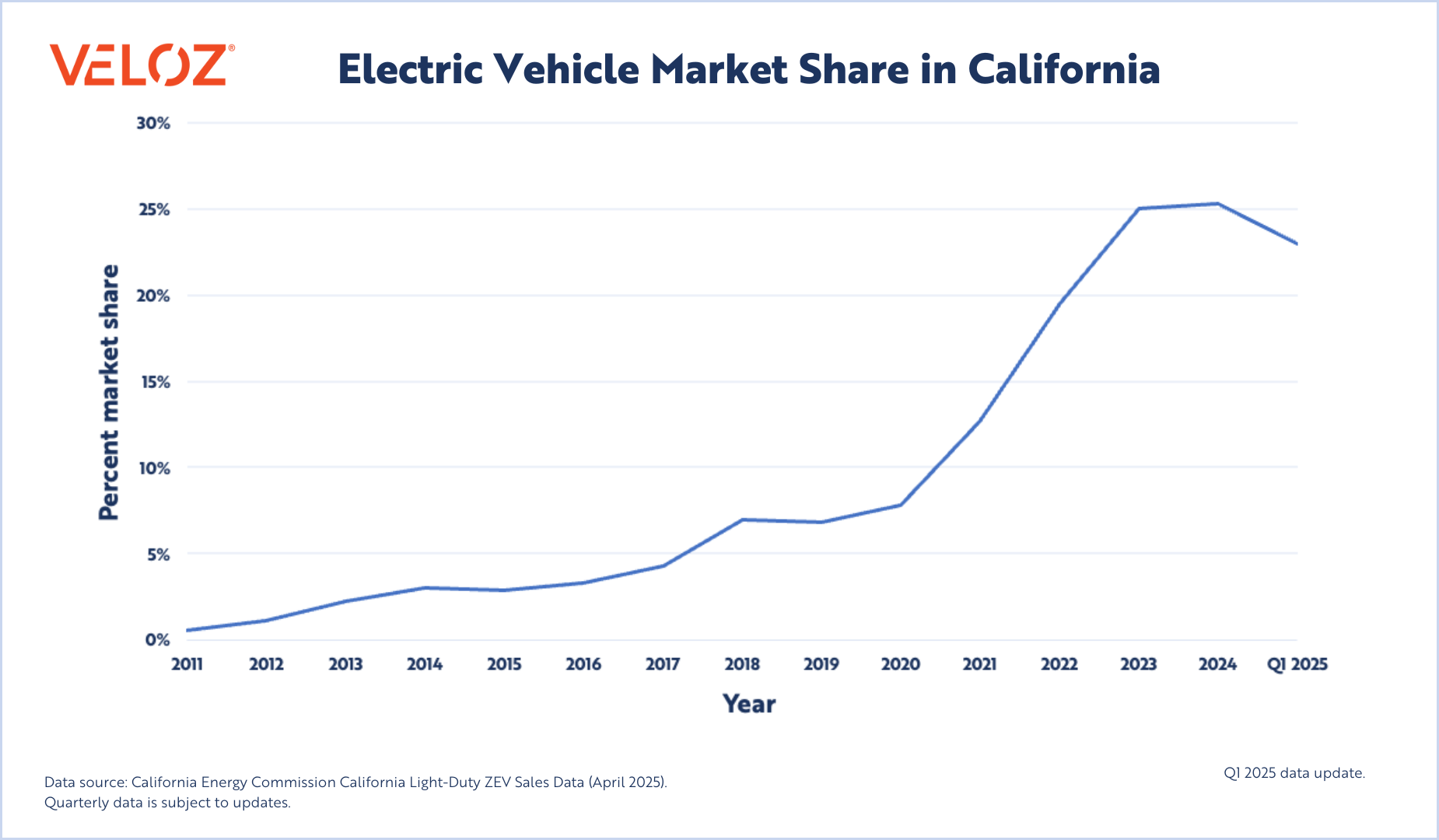

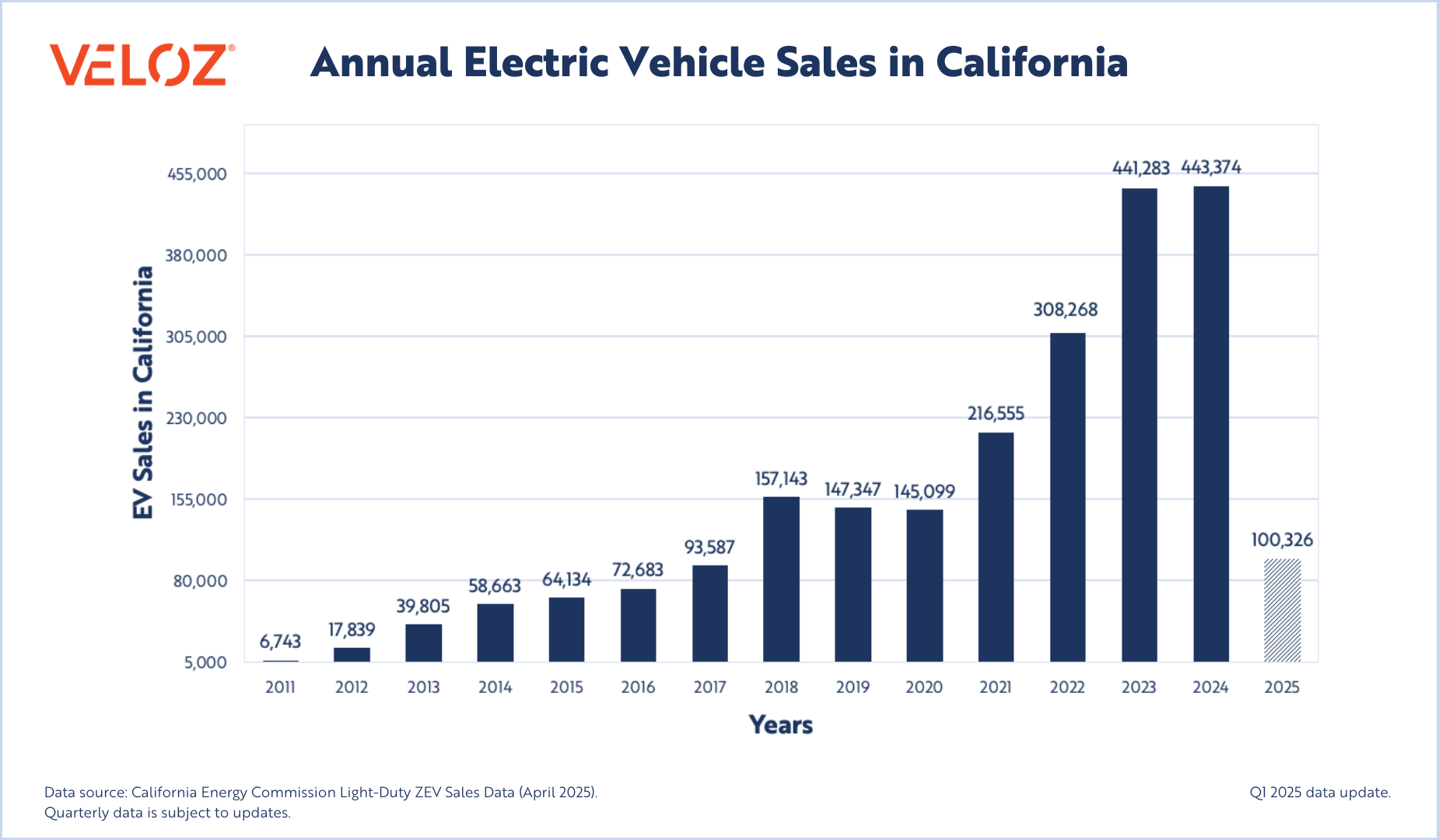

In the first quarter of 2025, Californians purchased 100,326 electric vehicles, holding the state’s EV market share steady at 23%. While total EV sales declined slightly by 2.61% year-over-year, this shift was driven primarily by a 21.5% drop in Tesla registrations. At the same time, non-Tesla EV sales grew by 14%, now making up more than 62% of all EVs sold in the state, which marks a pivotal moment of diversification in California’s EV market. At the national level, total EV sales grew by 11.4% in Q1 compared to the same period last year. Consumers benefited from a wider selection of over 147 available EVs, up from 105 models in Q1 of last year. Greater affordability as battery prices fell approximately 20% in 2024, along with continued support from federal, state, and local incentives, and increased access to public and residential charging infrastructure also helped keep consumers interested in buying EVs. The road to electrification in California is no longer being driven by a single brand — it’s being paved by choice.

In California, several legacy automakers saw standout gains for Q1 2025. Ford’s EV sales climbed 24.1% year-over-year, BMW rose 26.27%, and Chevrolet surged 44.12%, powered by new model rollouts and pricing strategies that resonated with cost-conscious buyers. Honda’s Prologue, launched in mid-2024, quickly became the third highest-selling EV in the state, with over 3,500 units sold — an impressive milestone reached in under a year, signaling strong consumer demand for new offerings from trusted brands. Volkswagen’s ID.4 remained a reliable choice, ranking ninth among California’s top ten EVs and posting a modest 2% sales increase. Meanwhile, Toyota and Subaru’s jointly developed bZ4X/Solterra platform gained notable momentum, with sales jumping 126.94% to 2,544 units. Strategic moves like price reductions of up to $6,000 and battery improvements that enhanced range and charging times likely helped drive consumer interest. These outcomes point to a market no longer reliant on early adopters or a single brand, but increasingly shaped by established automakers expanding their EV footprints.

Top Ten Selling EVs in CA:

- Tesla Model Y – 20,547 vehicles

- Tesla Model 3 – 13,391 vehicles

- Honda Prologue – 3,489 vehicles

- Hyundai IONIQ 5 – 3,222 vehicles

- Ford Mustang Mach-E – 2,771 vehicles

- Toyota/Subaru bZ4X/Solterra – 2,544 vehicles

- BMW i4 – 2,480 vehicles

- Chevrolet Equinox EV – 2,452 vehicles

- Volkswagen ID.4 – 1,911 vehicles

- Tesla Cybertruck – 1,830 vehicles

The California Energy Commission (CEC) is also reporting meaningful advancement in the medium- and heavy-duty sector with a cumulative 1,507 medium- and heavy-duty electric trucks, 2,555 electric buses, and 1,795 electric delivery vans sold statewide. This growth reflects both strong public investment and a shifting private market. In February 2025, Rivian announced that its previously Amazon-exclusive electric delivery van is now available to all commercial fleet operators, expanding access to zero-emission delivery options. That same month, the CEC launched a new Medium- and Heavy-Duty Zero-Emission (MDHD) Vehicle Infrastructure Dashboard, showcasing more than 16,000 charging points across California. The new tool increases infrastructure deployment transparency and helps stakeholders assess statewide readiness to support continued MDHD ZEV adoption.

California remains the national leader in full-size zero-emission buses, with 2,555 buses in operation at the end of 2024. Supporting this momentum, U.S. transit bus manufacturer El Dorado National California — a subsidiary of Rivaz — announced that it will restart bus production and customer deliveries in the coming weeks, following an operational ramp-up under new ownership. This signals renewed domestic manufacturing capacity and reinforces the state’s leadership in advancing clean transit solutions.

California’s infrastructure buildout continues to lay a strong foundation for a continued EV transition. In March, the state announced it now has 48% more EV chargers than gasoline nozzles, with over 178,000 public and shared private chargers installed statewide. Thousands of new chargers are coming online each quarter, supported by over 700,000 home chargers already in place. This growth is driven by the state’s $1.4 billion infrastructure investment plan approved in late 2024 — the largest of its kind in the nation — which also includes $55 million earmarked to bring fast chargers to rural and underserved areas through programs like Fast Charge California. At the same time, streamlined permitting and grid interconnection efforts are reducing delays, while utilities continue preparing for long-term power needs.

Equity remains a priority in California’s clean transportation strategy. Income-qualified programs such as Driving Clean Assistance continued to expand in Q1, increasing support for lower-income drivers in regions like Los Angeles and San Diego. Combined with falling battery costs and stronger incentives, these initiatives help ensure that the benefits of EV adoption reach every community. As more automakers introduce affordable models and state policies continue to support broad access, California is well-positioned to meet its ambitious zero-emission goals.

Across the U.S., electric vehicle sales grew by 11.4% year-over-year in Q1 2025, significantly outpacing the broader auto market. This growth came despite macroeconomic uncertainty and policy shifts, reinforcing the momentum behind EV adoption nationwide. Federal incentives continue to support EV affordability and access, though their long-term availability remains uncertain as future legislation and funding decisions are still in flux.

General Motors (GM) emerged as a key player, nearly doubling its EV sales to over 30,000 units during the quarter. Chevrolet led this performance with a 114.2% increase, driven by demand for the Equinox and Blazer EVs. Including affiliate sales from Honda and Acura, GM and its partners captured 16% of the national EV market.

IONNA, a joint venture backed by eight major automakers — including BMW, GM, Kia, Honda, Mecedes-Benz, Hyundai, Toyota, and Stellantis — entered its national release phase in February 2025. With over 100 sites secured and its first flagship “Rechargery” launched in North Carolina, the network plans to deploy 1,000 ultra-fast charging bays by year’s end and 30,000 by 2030. IONNA’s stations will feature Plug & Charge, AI-powered smart routing, and Amazon’s Just Walk Out technology, marking a significant step forward in EV charging accessibility and convenience.

In the first quarter of 2025, Ford, Kia, and BMW reported significant nationwide electric vehicle (EV) sales in the United States, highlighting the continued diversification and resilience of the U.S. EV market.

Ford retained its position as the nation’s second-best-selling EV brand, delivering 22,550 electric vehicles—a year-over-year increase of 11.5%. This growth was driven by strong performances from the Mustang Mach-E, which saw a 21% increase to 11,607 units, and the E-Transit van, which experienced nearly 30% growth. BMW reported a 26.4% year-over-year increase in U.S. EV sales, totaling 13,538 units. The i4 sedan led this growth with a 57% increase to 7,125 units, while the iX SUV climbed 23.1% to 3,626 units. Subaru’s all-electric Solterra saw a 173% year-over-year increase in U.S. sales in Q1 2025, reaching 3,131 units sold, including the brand’s best-ever EV sales month in March. The sharp uptick in sales for the Solterra follows a $6,500 price reduction and reflects growing consumer interest in more affordable, all-wheel-drive EV options.

These results signal a national inflection point powered by the rise of legacy automakers, EV adoption is no longer concentrated in early markets but accelerating coast to coast, laying the foundation for a truly nationwide shift in how America drives.

For media inquiries, please contact Margaret Mohr, Veloz Communications Director, at margaret.mohr@veloz.org.